Hyperverse scams

Have you fallen victim to a Hyperverse scam? Get in touch and take the first step to recovering what’s rightfully yours.

Understanding the hyperverse scam

What is the HyperVerse scheme?

HyperVerse was a fraudulent crypto investment scheme, said to have totalled almost $2 billion from unknowing investors around the world.

-

Detailing the hyperverse scheme

-

Pyramid scheme

-

Financial warnings

About HyperVerse

What was the purpose of HyperVerse?

Start your claim

Was HyperVerse a fake platform?

Who is the founder of HyperVerse?

Start your claim

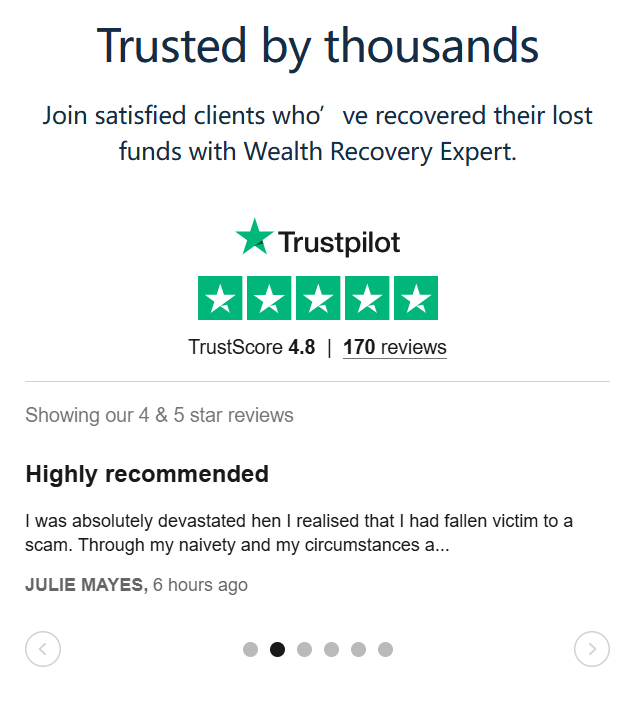

Why Wealth Recovery Expert

Supporting you is our priority. That’s why we provide personalised plans and care around the clock to our clients.

-

Personalised plans

Get a bespoke recovery programme for personalised support and the most cost-effective plans.

-

Care around the clock

Being a victim of fraud can be devastating. We’re available for expert guidance and support when you need it most.

-

Regulated and reputable

Access ethical, transparent, and secure support from a SRA-regulated firm.

Meet the specialists by your side

Recovering over $45,000,000 for clients like you

Over the past 3 years, we’ve recovered more than $45,000,000 for our clients. It’s thanks to our team of solicitors and recovery claim specialists who trace and recover the investments you’ve lost from scams. Plus, we offer a no-win, no-fee service. You won’t pay a thing unless we recover your money.

Frequently asked questions

-

Was HyperVerse a fake platform?

Although the HyperVerse platform was very much real, in that it allowed investors to “invest” their funds and offered a Metaverse-style interaction between members, it was ultimately a pyramid and Ponzi scheme style of scam. There was no money to be made from investing on the platform, with those who did manage to make withdrawals doing so from the deposits and memberships of newer members.

As with all Ponzi and pyramid schemes, the funds had to run out eventually and, when HyperVerse collapsed, the only people who seemed to make a profit were its founders, leaving investors in the dark about where exactly their money had gone and whether it could be recovered.

-

What was the purpose of HyperVerse?

HyperVerse was a decentralised Blockchain platform, which allowed users or members to socialise and trade with one another. It was unique from other platforms in that it combined a focus of gaming and socialisation and had its own token – HVT. HyperVerse was a virtual cosmos which allowed users – called Voyagers within the platform – to create and trade virtual items. It was a highly interesting concept and one which, if legitimate, would have likely been successful within the Crypto industry with the unique blend of Blockchain and Metaverse.

-

Who is the founder of HyperVerse?

The HyperVerse scheme was founded by Australian entrepreneur Sam Lee, along with his business partner Ryan Xu. It is one of many different investment schemes set up by the duo, especially under the HyperFund umbrella. They also co-founded the collapsed Blockchain Global – an Australian Bitcoin company – which was put into administration in 2021 and is noted to still owe its creditors roughly $58m. As well as HyperVerse and Blockchain Global, Lee and Xu have publicly promoted various other failed crypto schemes which have also led to traders being unable to withdraw their funds and initial investments.

These different schemes have all seen the same results, and that’s investors losing their deposits. As of January 2024, the founders have been hit with both criminal and civil charges, only adding to the chequered history of defunct schemes.